The Ultimate Guide To Will I Lose My Tax Refund When Filing Bankruptcy

Even though the courtroom will not have finalized your bankruptcy plan, you’ll begin earning every month Chapter 13 payments the thirty day period after you file. The payments will be refunded When the bankruptcy courtroom doesn’t verify your program.

Inquire an issue regarding your monetary situation giving as much detail as possible. Your info is stored secure rather than shared unless you specify.

He or she can be wrong within their analysis. Make certain the evaluation was suitable. Speak to a Woodbridge bankruptcy law firm at Fisher-Sandler Legislation to get a no cost Original session to discuss your economic circumstance.

Estate’s Tax Return: The bankruptcy estate is taken into account a independent taxable entity in Chapter 7 situations. The trustee may must file a tax return with the estate, often called Variety 1041, Should the estate generates greater than a specific level of money.

Permit’s take a closer examine Just about every possibility, And exactly how it affects your finances just before, throughout and following your bankruptcy.

Initial, find a bankruptcy attorney who will offer you a totally free evaluation and estimate on Anything you’ll need to spend to file.

S. Trustee Method-accepted agency. This program can help evaluate regardless of whether you make ample funds to pay for again All those you owe. The program need to be taken within just one hundred eighty days ahead of filing for bankruptcy. The counseling cost is about $fifty.

Ensure certainty with exact matches using our proprietary algorithm, which includes the latest in entity useful content resolution technology.

Victoria Stoner Your circumstance is exclusive and I am committed to giving individualized remedies towards your legal issues.

One of many number one issues I get questioned when speaking about bankruptcy with possible customers is, “If I file bankruptcy, will I have the ability to hold my tax refund?” find more info This problem, although it might spotlight the trouble that A lot of people experience, is an effective a single to talk to if you usually get a refund.

All of our articles is authored by remarkably qualified experts and edited by subject matter professionals, who make certain all the things we publish is aim, precise and click for more reliable. Our banking reporters and editors give attention to the points consumers care about most — the top banks, latest premiums, different types of accounts, dollars-saving suggestions plus much more the original source — so you're able to feel assured when you’re running your money.

No matter whether it’s Chapter 13 or 7 or eleven, no bankruptcy filing eradicates all debts. Youngster help and alimony payments aren’t dischargeable, nor are pupil loans and many taxes. But bankruptcy can get rid of many other debts, even though it More Bonuses will probable allow it to be more challenging for you to borrow Later on.

The sort of bankruptcy you file can drastically affect your tax return. In Chapter seven bankruptcy, certain different types of tax debts could be discharged totally. In distinction, Chapter 13 bankruptcy typically includes tax debts inside a repayment plan, making it possible for you to pay for them about a length of time.

We have been an unbiased, marketing-supported comparison assistance. Our intention is to help you make smarter economical conclusions by supplying you with interactive resources and fiscal calculators, publishing authentic and objective articles, by enabling you to definitely carry out study and Examine details at no cost - to be able to make monetary selections with assurance.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Macaulay Culkin Then & Now!

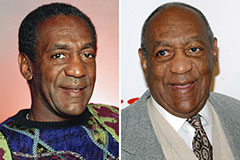

Macaulay Culkin Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!